The manufacturing stages of our polyester pools

The manufacture of our polyester shell pools begins with a rigorous selection of materials. The gel coat, a special resin applied to the surface, ensures watertightness and durability of the pool.. This is followed by layers of fiberglass and polyester resinresin, providing the structure with strength and flexibility. This combination of materials ensures a long service life and enhanced resistance to temperature variations and chemicals. All this, while maintaining an excellent value for money !

Our production machines, equipped with the most advanced technology, guarantee a flawless finish and perfectly lined basins. Every shell pool is meticulously inspected at every stage of production to ensure that it meets our strict quality standards.

A fast, efficient installation process

At Aboral, we're always one step ahead. To meet our customers' expectations in terms of speed and efficiency, we offer a shell pool installation in just 4 days.

Once manufactured, our ready-to-install pools are shipped directly to you and installed by qualified technicians, ensuring rapid, trouble-free commissioning.

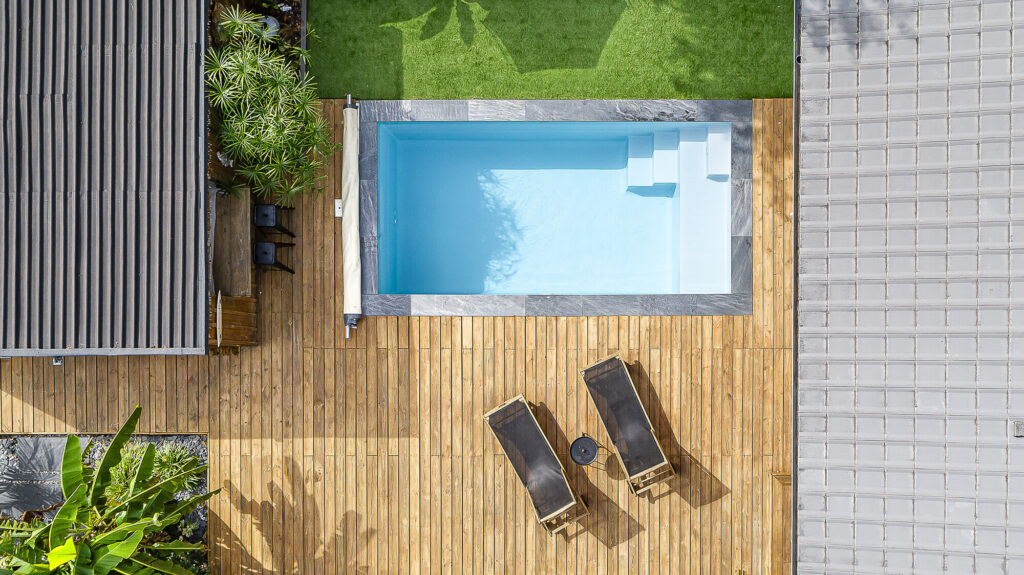

Configure the pool that suits you in 2 minutes

Choosing Aboral means enjoying an in-ground pool with complete peace of mind. Thanks to our ten-year warranty* and our selection of the best products available on the market, you can be sure of total peace of mind. We offer a wide range of models of shell poolsfrom the mini pool to large pools, including pools with underwater shutter box.

An intuitive online configuration tool

We know that every pool project is unique. That's why we offer an online configuration tool specially designed to enable you to customize your polyester shell pool according to your needs and desires. This simple, intuitive tool guides you step by step to create the pool of your dreams in just a few minutes.

Thanks to our configurator, you can choose from 28 polyester pool models, 5 shell colors and a host of equipment to create the pool of your dreams. What's more, our pools offer advanced customization options, allowing you to select :

- A heating system ;

- A salt salt treatment ;

- Pool covers (automatic or bar covers);

- A cleaning robot.

In less than two minutes, you'll receive a personalized quote within 24 to 48 hours.

Personalized advice every step of the way

Whatever the characteristics you wish to give to your shell swimming poolour production tools are capable of meeting every one of your needs, to guarantee a pool that reflects your image. And because a a pool construction project is not to be taken lightly, our experts are there to support you in every decision, from selecting the shape and size of your poolto color and equipment.

Whether you want a shell pool with an immersed cover box or a sloped-bottom poolour team is ready to turn your ideas into reality. They will provide you with personalized advice to ensure that every aspect of your pool meets your specific needs and expectations.

Customized support throughout your project

At Aboralour customers are at the heart of our concerns. We're with you every step of the way stage of your projectfrom conception to final delivery and beyond.

A dedicated contact person will be assigned to you, guaranteeing an attentive ear and a rapid response to all your questions and needs.

Personalized support

Your a swimming pool? ? Do you have a preference in terms of material or color? Aboral, your pool specialist in Bordeauxis there to advise you and adapt your project accordingly. We make sure that every pool complies with the most stringent processes and quality controls.

And when the building work is finished, we won't leave you alone. Our online store, Aboral Shopoffers everything you need to maintain and equip your pool: covers, heat pumps, pool robots and more. You'll also find expert advice and detailed comparisons to help you tailor your equipment to your pool's specific needs.

Responsive after-sales service

Our sales department is at your disposal to answer any questions you may have before, during or after installation of your shell pool. We're proud of our after-sales service, and we're committed to providing you with fast, efficient assistance so you can enjoy your pool worry-free.

Got a question? No problem, our sales department is on hand to answer any questions you may have.