Are you dreaming of a swimming pool to enjoy your garden to the full in summer, but the idea of paying extra taxes is putting you off? Good news: not all swimming pools are subject to local taxes!

Size, type of structure, length of installation... A number of criteria come into play to determine whether your pond will be taken into account in the calculation of your property taxyour development tax or council tax.

Without further ado, discover our tips for installing a swimming pool without seeing your tax bill skyrocket!

Pool taxation: what you need to know

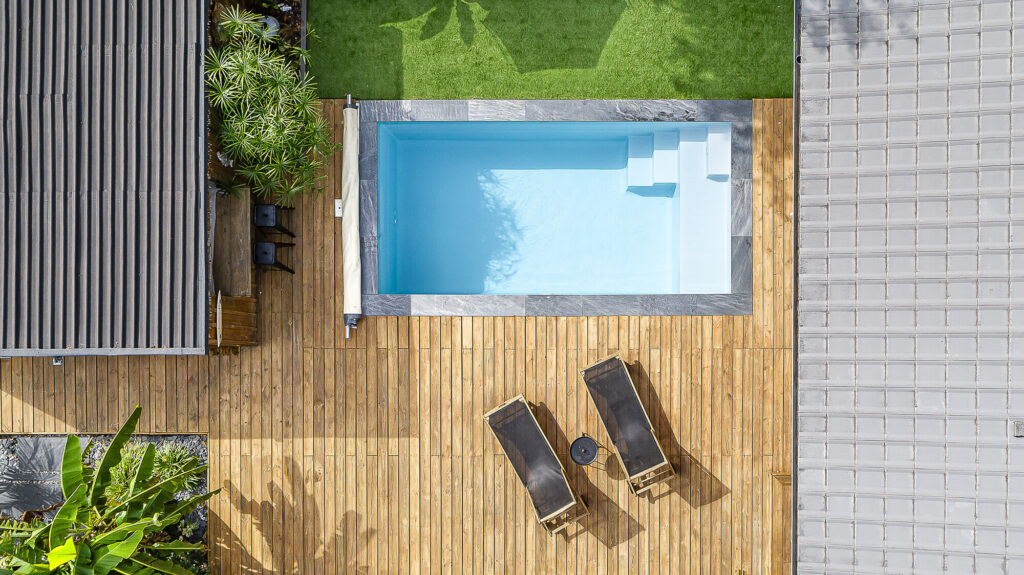

Installing a swimming pool in your garden is a real asset for the comfort and value of your property. Indeed, a pool adds significant value to your home, which can be an advantage if you're thinking of reselling your house.

However, this increase in value has a direct consequence: it leads to a revaluation of your property by the tax authorities, and therefore a potential increase in your taxes. potential increase in your taxes. As soon as a pond is considered a permanent fixture, it is taken into account for several local taxes, including :

- The property tax A ground-mounted swimming pool attached to your property increases the cadastral rental value of your property, which in turn increases your property tax.

- The development tax As soon as a swimming pool exceeds 10 m², it is subject to a specific tax, payable only once, but which can amount to several hundred euros depending on your municipality.

Good to know: You have 90 days following completion of the work to file a prior declaration with the property tax office. If you forget, you risk a tax reassessment!

Fortunately, some swimming pools are exempt from these taxes.

Pools to choose so as not to be taxed

Not all pools are subject to taxation. If you wish to build a swimming pool and avoid having your tax bill increase, here are the types of pools you should consider.

Avoid taxes with 10m pools2

When it comes to taxation, the rule is simple: according to the French General Tax Code (CGI), the surface area of a non-taxable swimming pool must be less than 10 m². Why is this? Because these mini pools are considered minor improvements that do not significantly affect the cadastral value of your property.

In addition to this significant tax advantage, the mini-pools offer a host of advantages:

- No administrative declaration no need to apply for a building permit or a prior declaration of workunless you're in a protected or listed area.

- A compact, practical format: ideal for small gardens, yet offering ample bathing space for relaxation.

- Reduced maintenance and costs: less water, fewer cleaning products, less heating... all to your advantage!

- Possibility of adding top-of-the-range equipment: a counter-current swimming system or a high-performance filtration system to optimize the experience without increasing the tax bill.

In short: A tax-free tax-free swimming poolno paperwork and a real pleasure to swim in!

Good to know: Before you embark on buying a mini-poolcheck local regulations with your local council. Some communes impose specific restrictions, even on pools smaller than 10 m².

Above-ground and demountable pools: a flexible option

Another tax-free alternative: above-ground above-ground poolsprovided they meet two essential criteria.

- It must be completely demountable and not fixed to the ground: if your pool simply rests on the ground and does not involve any masonry work, it will not be taken into account by the tax authorities. Conversely, an above-ground pool installed on a concrete slab or surrounded by fixed fittings may be considered a permanent installation and therefore taxed.

- It must not remain in place for more than 90 consecutive days: if you install an above-ground pool for the summer and dismantle it before the arrival of autumn, you escape all taxation. On the other hand, if it remains in place for more than three months, it may be requalified as a permanent installation and subject to local taxes.

Other tax-free pool solutions

If your pool is not one of the tax-exempt models (in-ground or semi-in-ground pools with a surface area greater than 10m2), you are required to declare it to the tax authorities and pay the associated taxes.

However, there is a solution for deferring payment of property tax: temporary exemption.

In fact, certain new buildings, including swimming pools, can benefit from a property tax exemption for two years. This is a particularly attractive way of reducing the tax burden associated with the installation of your pool.

However, to take advantage of this offer, it is imperative to comply with one essential condition: declare completion of work within 90 days of completion. Without this administrative formality, the exemption cannot be applied and the pool will immediately be subject to taxation.

As you can see, the addition of a swimming pool can increase the rental value of your property, resulting in higher property and development taxes. However, there is a way to reduce these additional costs: make sure you choosing the right size for your pool.

The mini-pools are ideal for those who want to enjoy the pleasures of swimming without the administrative and tax complications associated with larger models Other types of pools, such as kit or above-ground poolsalso offer economical, flexible solutions.

Do not hesitate to contact an Aboral expert to find out more!

Configure your pool online Back to all news